It looks like you're using an Ad Blocker.

Please white-list or disable AboveTopSecret.com in your ad-blocking tool.

Thank you.

Some features of ATS will be disabled while you continue to use an ad-blocker.

share:

originally posted by: camaro68ss

tax wealthy people to give money to the government so the government officials can line there pockets.

OR...Tax unearned income more while offering tax breaks for active investment in businesses and job creation.

Or hell...just bring the tax rate up on unearned income to the same level the average Joe pays on earned wages.

The wealthy can keep their money, they will just move their investments to vehicles that benefit the economy and create jobs.

As it stands we incentivize just the opposite.

The wealthy will not sit idle and pay a higher tax rate...they will move the money to vehicles that invest in businesses vs. Food and Energy futures...vs. shelters abroad.

originally posted by: C0bzz

So, the purpose of taxing the rich more is generally to counteract this phenomena to provide more services - like healthcare, education, housing, food, opportunities to those who are disadvantaged (as well as the working class), helping to break the aforementioned cycle, provide a safety net incase of disease or illness, and stop the trend for wealth redistribution to the top.

But...... the "rich" ARE taxed more right NOW and we STILL have these problems you mention. We have had a war on poverty for 50 years that hasn't suceeded in the way it should have, given all the money thrown at the problem. Article

It appears that government programs significantly reduce the number of people living below the poverty line. Yet at the same time, by any global standard, America’s performance in turning economic growth into poverty reduction is incredible—as a negative outlier.

Government spends too much, too freely. The thought that it will be the Government that will bring prosperity to all is a very misguided notion. Entrepreneurship and Innovation have been the driving forces of economic progress, neither of which Governments tend to do well.

Putting your hope and money into the Government thinking it will save America by spending your tax dollars better than you can is foolish. It will be small business that ignites the American economy in a way that trully benefits American Citizens.

originally posted by: Indigo5

...yes he is self-made.

Very easy to be self made when your family spots you $700,000 (2013 dollars) to start up an investment company.

Even easier to make that company profitable when you have no overhead costs as you are being given office space, for free, at your dad's old brokerage...the same brokerage that you used to create your investment network while directly employed by your dad.

Self made...bwahahahaha.

originally posted by: grandmakdw

a reply to: peck420

Please read my post above.

The problem is not rich people.

The problem is the government elite.

I made no issue with your view of the problem.

I do have issue with people idolizing persons that used and abused to obtain their wealth, because they are willing to give out a pittance today for good publicity.

originally posted by: Indigo5

originally posted by: camaro68ss

tax wealthy people to give money to the government so the government officials can line there pockets.

OR...Tax unearned income more while offering tax breaks for active investment in businesses and job creation.

Or hell...just bring the tax rate up on unearned income to the same level the average Joe pays on earned wages.

The wealthy can keep their money, they will just move their investments to vehicles that benefit the economy and create jobs.

As it stands we incentivize just the opposite.

The wealthy will not sit idle and pay a higher tax rate...they will move the money to vehicles that invest in businesses vs. Food and Energy futures...vs. shelters abroad.

Not a bad idea. Probably would be harder to implement that it would appear. It would be a step in the right direction though. You don't have to penalize the rich for being rich, you can incentivise their investing choices though to steer capital to where you want. Anything to get more capital freed up for smaller businesses to startup and thrive would be a great start.

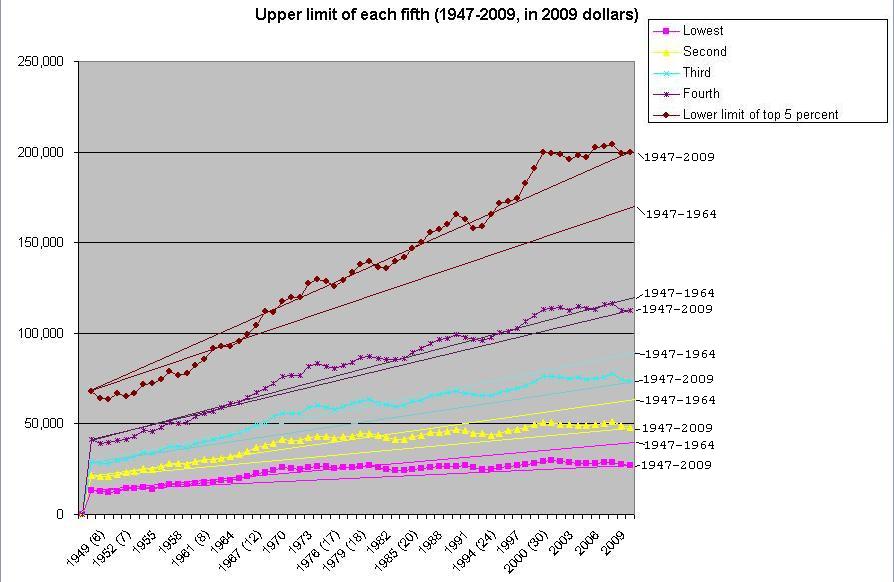

For example the SBA, Small Business Administration, typically the small business isn't really that small. Trying getting a $75,000 loan to start up a biz and you will see what I mean. Chart

We need to have a strategic long range plan to create fertile conditions for new small business growth. Unfortunately our government rarely thinks beyond the next election and where their money will come from to wage their re-election campaign.

originally posted by: thisguyrighthere

So how does taking 80% of what some rich guy has help put money in my pocket?

Is it supposed to trickle down from the government to me? My taxes will go away? My mortgage will get paid? Cars will become more affordable? Food and gas won't be going up week after week?

Connect the dots for me. Don't use hypothetical or promises of government action because those are fairy tales.

Take a dollar from a rich man and increase my quality of life. Go through it from A to B to C so I can see how this action will directly benefit me.

The explanation is a bit complicated. It's economics... only, many economists don't seem to realize it. Money has no inherent value, it only has the value that we and others place upon it - like most every other type of good and service. Economists tend to forget this.

Picture ye olde Econ101 Supply and Demand curve. Absent all else, the demand curve of money is perfectly elastic - a horizontal line stretching to infinity. That is to say, everyone will always want more money absent other factors. At a given moment in time, the supply curve of money is perfectly inelastic - a vertical line stretching to infinity. While banks create and destroy money all the time, it has a fixed size at any given moment in time.

So, with two flat curves for money, who determines the distribution? As we see in history, it isn't distributed equally. Here, the concept of power from political science is relevant. Power is essentially: who gets what, when, and how. Money itself is commonly recognized as a form of power, and so more money means more power. With more power, an individual has more opportunity to influence the distribution of money.

You can probably see where this is going: money is accumulated by the rich (and thus powerful), until one individual emerges victorious (~Highlander reference~) with all of the money - a monopoly, if you will. Monopolies are the end-state of unrestricted capitalism in a market.

Now, there are some mitigating factors to this - chiefly amongst them is marginal income tax. Let me explain: marginal utility comes into play. While the average person could earn more money working a second/third job or not sleeping, the utility of sleep and recreation tends to be more valuable - sleep is necessary, so it has a very high utility. Sleep is a fairly obvious disincentive to earning more income: it reduces the demand for more money because a person is physically incapable of working continuously. The way such a fixed disincentive works on a perfectly elastic demand curve is by making what appears to be steps - a flat demand curve up until the disincentive, then a step down, and again a flat demand curve.

Tthe way a government can implement such a disincentive on earning more income is through marginal income taxes. So, at the end of each increasing marginal income bracket, there would be a step down. The current final 'step' is now at about 39% at $398,351. After that, demand returns to perfect elasticity. There is no marginal income tax disincentive past this point.

Now to get to your question, I would argue that 39% is far too low. Back in the 1950s, the United States of America had a 90% marginal tax rate at the highest income bracket. This is sometimes called the Golden Age of the United States. Few people reached that highest marginal tax rate - because of the disincentive of doing so. Reductions to these upper rates only came with the Revenue Act of 1964, which I trace as the beginning of our current set of problems. After that point, things began to get worse. Rates were reduced to 70% in this act... and in subsequent acts, rates were reduced even further. Consider:

Remember that income is fixed at a given point in time. An individual with more power over the distribution of income might take just a bit more of his or her share, and so on, until there is nothing left to distribute. Hence, the reason the rich are getting richer is because they are taking more than their share from those with less power than them.

With less reason to take more - higher marginal income tax rates that go to the government instead of their pocket (who wants to give the government 90 cents out of $1?) - there would be more for those who had less. Only the people who put wealth as their highest utility would keep accumulating more at that point. Thus, a higher marginal income tax should help you - unless you're in the highest marginal income tax bracket.

edit on

13Fri, 25 Apr 2014 13:36:45 -0500America/ChicagovAmerica/Chicago4 by Greven because: (no reason given)

An 80% tax would slowdown the buying of our politicians, if we did not have these sellout politicians in office our government might be able to buy a

new bridge or fix the highways.

How do you earn over %500,000 in a year?

You have others work to make your fortune for you! Oh sure there are a few exceptions, like Enron. sarcasm

One thing that is not being discussed enough in my opinion is a strong middle class was also good for the poor and kids as their was more day work in our neighborhoods. I'd rather see kids mowing lawns and doing odd jobs than see them sitting around or worse turning to drugs and or crime.

How do you earn over %500,000 in a year?

You have others work to make your fortune for you! Oh sure there are a few exceptions, like Enron. sarcasm

One thing that is not being discussed enough in my opinion is a strong middle class was also good for the poor and kids as their was more day work in our neighborhoods. I'd rather see kids mowing lawns and doing odd jobs than see them sitting around or worse turning to drugs and or crime.

originally posted by: AlaskanDad

An 80% tax would slowdown the buying of our politicians, if we did not have these sellout politicians in office our government might be able to buy a new bridge or fix the highways.

How do you earn over %500,000 in a year?

You have others work to make your fortune for you! Oh sure there are a few exceptions, like Enron. sarcasm

One thing that is not being discussed enough in my opinion is a strong middle class was also good for the poor and kids as their was more day work in our neighborhoods. I'd rather see kids mowing lawns and doing odd jobs than see them sitting around or worse turning to drugs and or crime.

Actually I think it would *Accelerate* the buying of our politicians.

Why?

They will go underground and use cash and favors.

The criminal mafias do it all the time. Always have, always will.

The answer to solving poverty will NEVER be answered by the government taxing people and redistributing it to the poor. It doesn't matter how much

money they take, there will always be those in poverty. I'm okay with safety net programs, but lifelong government bennies create a dependent slave.

If there is less money for the rich to spend on politics it is everyones favor but that of the rich.

50 years of tax breaks has failed to cause trickle down effect to the people, I see no reason to try it another 50 years, we know better than to repeat same experiment and expect different results and all that.

So why stick up for them that make their fortunes on others hard labors?

Or worse like Monsanto?

50 years of tax breaks has failed to cause trickle down effect to the people, I see no reason to try it another 50 years, we know better than to repeat same experiment and expect different results and all that.

So why stick up for them that make their fortunes on others hard labors?

Or worse like Monsanto?

I still don't like the progressive tax idea. It only makes things worse. I am adamant on the flat tax rate because by doing so.... it will create

something new. I don't know what it will be, but money will begin to flow about the country and maybe companies can actually start paying the minimum

wage instated by the US government. (I work at a rate of $5.15 an hour as a delivery driver.)

What I am saying is that this system of currency and the economics that follow it seems to be placing a price on everything. And it really boils down to supply and demand. But what we don't realize ourselves is that our quality of our SOUL, not LIFE, is diminished because of it.

When was the last time you actually helped out a friend? And I am not talking about JUST LENDING MONEY. I am talking about HELPING someone with their car troubles, their living situation, or some other various genre of help given that you didn't ask money for AT ALL?

What I am saying is that this system of currency and the economics that follow it seems to be placing a price on everything. And it really boils down to supply and demand. But what we don't realize ourselves is that our quality of our SOUL, not LIFE, is diminished because of it.

When was the last time you actually helped out a friend? And I am not talking about JUST LENDING MONEY. I am talking about HELPING someone with their car troubles, their living situation, or some other various genre of help given that you didn't ask money for AT ALL?

How many miles to the border, north or south?

If I were rich, never mind, just smart.

Where would I take my business?

Same place these U.S. companies did.

*****Warning****

List is terribly long!!!!!

U.S. companies in Mexico

If I were rich, never mind, just smart.

Where would I take my business?

Same place these U.S. companies did.

*****Warning****

List is terribly long!!!!!

U.S. companies in Mexico

a reply to: Oaktree

Well you might not have noticed but it has already got to the point that very little is being made in the USA, most the name brand tools I buy are marked made in China.

But hey we can argue all day about the what ifs and why nots, and keep all of our problems.

I will really get in trouble for saying this; but no one that makes less than a living wage should have to pay any taxes, income, sales or property. I mean if you don't make enough to live on taking your money for taxes is just plain greed and or ignorance.

Well you might not have noticed but it has already got to the point that very little is being made in the USA, most the name brand tools I buy are marked made in China.

But hey we can argue all day about the what ifs and why nots, and keep all of our problems.

I will really get in trouble for saying this; but no one that makes less than a living wage should have to pay any taxes, income, sales or property. I mean if you don't make enough to live on taking your money for taxes is just plain greed and or ignorance.

edit on 25-4-2014 by AlaskanDad because: oops a couple typos needed fixed

originally posted by: theMediator

A lot of you guys are complaining but are no where near making 500k a year...

Ok, sure 80% taxes sounds too much at first hand but let`s say I would come up with an idea like :

Taxing the rich 80%!

No no, wait wait, I would also give them conditional tax breaks.

How about if you make under 100k a year you get fined $1000 per month for not doing enough to support your country with taxes....

Fair is fair... right?

a reply to: Xtrozero

You must have missed the memo; anyone that make under a million a year shall be housed by our private prison industry,

Oops looks like you missed the memo because your income is under the cut off line.

Better luck in your next life!

How about if you make under 100k a year you get fined $1000 per month for not doing enough to support your country with taxes....

Fair is fair... right?

You must have missed the memo; anyone that make under a million a year shall be housed by our private prison industry,

Oops looks like you missed the memo because your income is under the cut off line.

Better luck in your next life!

originally posted by: GiulXainx

I still don't like the progressive tax idea. It only makes things worse. I am adamant on the flat tax rate because by doing so.... it will create something new. I don't know what it will be, but money will begin to flow about the country and maybe companies can actually start paying the minimum wage instated by the US government. (I work at a rate of $5.15 an hour as a delivery driver.)

What I am saying is that this system of currency and the economics that follow it seems to be placing a price on everything. And it really boils down to supply and demand. But what we don't realize ourselves is that our quality of our SOUL, not LIFE, is diminished because of it.

When was the last time you actually helped out a friend? And I am not talking about JUST LENDING MONEY. I am talking about HELPING someone with their car troubles, their living situation, or some other various genre of help given that you didn't ask money for AT ALL?

Sorry, but a flat tax is not going to help anyone save the richest of people. Generally when this is brought up, it will be too low, and thus benefit only the rich. And if my theory a few posts up is accurate, then it would increasingly concentrate wealth at the top worse than it already is. If it is too high, it'll be even worse, and it will disproportionally impact people who already earn too little.

The richest of people do not spend a lot of money. No, really - think about it for a second: people living paycheck to paycheck spend every single penny they earn. The rich don't have to spend 100% of their income on surviving, and so they can save and invest. The upper middle class can as well, but it's not as easy as it used to be. Similar story with the middle class. If you want to help grow the economy, get the poorest of people more money - simple!

Here's some food for thought - real, inflation adjusted income levels for households show very little growth in most quintiles from 1979 to 2005. I'm talking ~6% in the lowest, ~16% second lowest, ~21% in the middle, ~30% in the second highest, and ~80% in the highest. It's crazier when you look at the richest of the rich: over 225% gain at the top 1%.

There's one other big thing that changed other than taxes - women dramatically altered the workforce. They grew from 35% labor participation rate in 1948 to a 75.3% labor participation rate in 2005. So, between 1979 and 2005, it increased from just about 50% to 75.3%. Remember how most Americans have barely seen any real income rise? That's with the 50% higher participation rate of women!

Without this cultural change... things would probably look even worse. Part of it isn't even cultural, but driven by necessity. Single mothers, etc.

edit on 1Sat, 26 Apr 2014 01:18:49 -0500America/ChicagovAmerica/Chicago4 by Greven because: (no reason given)

a reply to: Greven

You have to give something to get something..... you have to take something to replace something else. Think about it this way. Rich people get the flat tax rate. They suddenly have buying power. They invest in say.... Samsung. ... or toyota.... or king scoopers. That money they spend in investments helps a company to pay their bills and their people..... suddenly they can afford better health care options for employees. Give raises higher than a nickel. Let them explore different options with their R&D teams. And ultimately.... LOWER THE PRICES OF THEIR GOODS.

The rich the rich the rich the rich the rich the rich the rich the rich THE RICH. Is all I hear coming from you. It seems like Rich is the new bad word of the 21st century. The new insult is "the rich." The new scapegoat is "the rich." It is no longer gatecrashing... its The rich.

The stock market is nothing like 30 years ago because no one wants to make a bet anymore. The rich people are constantly paying special interest prices for a brighter future. Meanwhile the old me saw rich people as these stuck up individuals who laugh at us poor people. And dangle a little disco ball above our houses and say "dance suckah!"

But then.... I drove a cab for a few years. And finally spoke with the two a hokes behind the uber app 7 months before it went live on the app stores. Met with a producer for energy efficient "grow lights." Met 7 different investors who constantly went back and forth to western union in lone tree. And even met three heavt tippers who I never got to know. My tip was 2,000.

All of these people I talked to were very powerfull people. And I always wanted to punch them in the face.

I argued with these a h's while I drove them to their destination until finally.... like I said... came to a new conclusion. Each and every RICH person I met was interested in furthering their companies. But because of the whole circus show that we forced the irs yo impose on the rich they can't do ANYTHING.

Companies are dying. It is not just microsoft wanting to sell tge xbox division. It is not just Sony killing the vaio and reverting back to lcd zcreens. It is not just TESLA trying to fight new york and new jersy over some stupid dealership clause. It is not only amd struggling to keep up with demand for litecoin rigs. It isn't just wal mart that has suddenly started getting into organic products. It isn't just farmers growing nothing but corn anymore.

This enture Fn country is eating itself alive. And you think China's ghost cities isn't going to happen here.

Seriously I will uphold the flat tax rate argument because you only think they are about staying rich when it is so much more than that. Take the PS4 vs XB1 for example here. PS4 finally came to be due to the fact that 5 chairmen gave up their bonuses to make the ps4 happen. "The rich" is the ps4. Then you have the xb1 come out with the worst news for console gamers. A drm system that utilizes a camera to ensure copyright claims. The xb1 is me 3 years ago attacking tge rich people by arguing with them in my cabs. Which console is the popular choice?

You have to give something to get something..... you have to take something to replace something else. Think about it this way. Rich people get the flat tax rate. They suddenly have buying power. They invest in say.... Samsung. ... or toyota.... or king scoopers. That money they spend in investments helps a company to pay their bills and their people..... suddenly they can afford better health care options for employees. Give raises higher than a nickel. Let them explore different options with their R&D teams. And ultimately.... LOWER THE PRICES OF THEIR GOODS.

The rich the rich the rich the rich the rich the rich the rich the rich THE RICH. Is all I hear coming from you. It seems like Rich is the new bad word of the 21st century. The new insult is "the rich." The new scapegoat is "the rich." It is no longer gatecrashing... its The rich.

The stock market is nothing like 30 years ago because no one wants to make a bet anymore. The rich people are constantly paying special interest prices for a brighter future. Meanwhile the old me saw rich people as these stuck up individuals who laugh at us poor people. And dangle a little disco ball above our houses and say "dance suckah!"

But then.... I drove a cab for a few years. And finally spoke with the two a hokes behind the uber app 7 months before it went live on the app stores. Met with a producer for energy efficient "grow lights." Met 7 different investors who constantly went back and forth to western union in lone tree. And even met three heavt tippers who I never got to know. My tip was 2,000.

All of these people I talked to were very powerfull people. And I always wanted to punch them in the face.

I argued with these a h's while I drove them to their destination until finally.... like I said... came to a new conclusion. Each and every RICH person I met was interested in furthering their companies. But because of the whole circus show that we forced the irs yo impose on the rich they can't do ANYTHING.

Companies are dying. It is not just microsoft wanting to sell tge xbox division. It is not just Sony killing the vaio and reverting back to lcd zcreens. It is not just TESLA trying to fight new york and new jersy over some stupid dealership clause. It is not only amd struggling to keep up with demand for litecoin rigs. It isn't just wal mart that has suddenly started getting into organic products. It isn't just farmers growing nothing but corn anymore.

This enture Fn country is eating itself alive. And you think China's ghost cities isn't going to happen here.

Seriously I will uphold the flat tax rate argument because you only think they are about staying rich when it is so much more than that. Take the PS4 vs XB1 for example here. PS4 finally came to be due to the fact that 5 chairmen gave up their bonuses to make the ps4 happen. "The rich" is the ps4. Then you have the xb1 come out with the worst news for console gamers. A drm system that utilizes a camera to ensure copyright claims. The xb1 is me 3 years ago attacking tge rich people by arguing with them in my cabs. Which console is the popular choice?

a reply to: GiulXainx

So you argued with some folks in a taxi that were rich in your opinion (what no limo? or maybe the chauffeur had the day off?), how much accumulated wealth and assets did they have? What type of yearly incomes were they taking down, were they the 1% or the remains of the crumbling upper middle class ?

Maybe if the 1% had not successfully lobbied for free trade we would still have import taxes / tariffs protecting American manufacturing!

Have you ever thought about where the mom & pop businesses went, I mean like the old family owned diners, you know the ones that we had before all the chain food places owned by the 1% like McD's, taco time, KFC, burger king, Denny's just to name a few. How many family owned convenience stores went broke trying to compete with 7-11 and AM PM's and all the other corporate owned mini marts?

When some one is making over $500,000 a year personal income they should be paying plenty of taxes, this kind of money is not gained by working but rather from working hard at profiting off others labors!

Yup the government is really hard on the rich and their Big Businesses:

Former Comcast and Verizon Attorneys Now Manage the FCC

The FCC’s New Net Neutrality Proposal Is Even Worse Than You Think

Verizon Knows You're A Sucker: Takes Taxpayer Subsidies For Broadband, Doesn't Deliver, Lobbies To Drop Requirements

Just a few of todays headlines; maybe those rich folks you met in the taxi were remnants from our declining middle class and not really the rich?

So you argued with some folks in a taxi that were rich in your opinion (what no limo? or maybe the chauffeur had the day off?), how much accumulated wealth and assets did they have? What type of yearly incomes were they taking down, were they the 1% or the remains of the crumbling upper middle class ?

Maybe if the 1% had not successfully lobbied for free trade we would still have import taxes / tariffs protecting American manufacturing!

Have you ever thought about where the mom & pop businesses went, I mean like the old family owned diners, you know the ones that we had before all the chain food places owned by the 1% like McD's, taco time, KFC, burger king, Denny's just to name a few. How many family owned convenience stores went broke trying to compete with 7-11 and AM PM's and all the other corporate owned mini marts?

When some one is making over $500,000 a year personal income they should be paying plenty of taxes, this kind of money is not gained by working but rather from working hard at profiting off others labors!

Yup the government is really hard on the rich and their Big Businesses:

Former Comcast and Verizon Attorneys Now Manage the FCC

The FCC’s New Net Neutrality Proposal Is Even Worse Than You Think

Verizon Knows You're A Sucker: Takes Taxpayer Subsidies For Broadband, Doesn't Deliver, Lobbies To Drop Requirements

Just a few of todays headlines; maybe those rich folks you met in the taxi were remnants from our declining middle class and not really the rich?

edit on 26-4-2014 by AlaskanDad because: changed a . to a ?

originally posted by: beezzer

originally posted by: Xtrozero

originally posted by: beezzer

Just hush up and buy a Xbox for someone who didn't earn it!

Why do you need to bring my kids into this?

Kids???

Do they need some trophies?

We'll give them to your kids, but if they try to better than anyone else. . . . well. . . we'll have to suspend them.

Sorry!

My kids are lucky, We didn't have kids until our late 30s and today they live rather well. They see how their friends live, how their friends parents struggle to provide, or in some cases do just the minimal needed to survive. We also talk about it all the time too. The progression of my life and how I got to where I am and the progression of the lives around them, and you know what they are both straight A students with little effort on my part.

But they understand the difference between "Rights" and "Privileges". They know that daddy can giveth and can taketh away in a heartbeat. They are learning how hard the world can be and that no one but Family really cares for them.

Before the 1970s our subsistence programs were much more limited, and the vast majority of help was from the private community. That help knew your name, who you were, who your kids were, what you really needed, what your real problems were and so on. Today the Government has replaced all that and people are just statistics now. The Government doesn't know who you are really. You are just a number buried in a large pool of numbers.

Obama's team was masterful in creating a new boogieman called the rich, an American cast system, but the funny part is that they are the ones to determine just what rich is. Is it a billionaire, 10 million, 1 million, 250k, 100k, 70k.... it is up to them to say.

Those families below 70k are all like "TAX THEM ALL!!!" as they pay little or no taxes, but wait until they are "The Rich" too...hehe

edit on 26-4-2014 by Xtrozero because: (no reason given)

a reply to: grandmakdw I personally don't think the money is going to trickle down to any body Once Uncle Scam gets his greedy

little fingers on it. It will be game over man. Hate to ask this ..............How does one do a post on here? Is there a post button?

edit on 26-4-2014 by Tarzan the apeman. because: Asking for help.

new topics

-

Any one suspicious of fever promotions events, card only.

The Gray Area: 14 minutes ago -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 4 hours ago -

Electrical tricks for saving money

Education and Media: 7 hours ago -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 9 hours ago -

Sunak spinning the sickness figures

Other Current Events: 9 hours ago -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 10 hours ago -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 11 hours ago

top topics

-

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News: 9 hours ago, 9 flags -

Cats Used as Live Bait to Train Ferocious Pitbulls in Illegal NYC Dogfighting

Social Issues and Civil Unrest: 13 hours ago, 8 flags -

Electrical tricks for saving money

Education and Media: 7 hours ago, 4 flags -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three: 17 hours ago, 3 flags -

Sunak spinning the sickness figures

Other Current Events: 9 hours ago, 3 flags -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues: 10 hours ago, 3 flags -

Late Night with the Devil - a really good unusual modern horror film.

Movies: 11 hours ago, 2 flags -

The Good News According to Jesus - Episode 1

Religion, Faith, And Theology: 15 hours ago, 1 flags -

Any one suspicious of fever promotions events, card only.

The Gray Area: 14 minutes ago, 1 flags -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology: 4 hours ago, 0 flags

active topics

-

SETI chief says US has no evidence for alien technology. 'And we never have'

Aliens and UFOs • 50 • : andy06shake -

Any one suspicious of fever promotions events, card only.

The Gray Area • 0 • : Cavemannick -

God's Righteousness is Greater than Our Wrath

Religion, Faith, And Theology • 1 • : andy06shake -

Sunak spinning the sickness figures

Other Current Events • 7 • : xWorldxGonexMadx -

HORRIBLE !! Russian Soldier Drinking Own Urine To Survive In Battle

World War Three • 33 • : Degradation33 -

How ageing is" immune deficiency"

Medical Issues & Conspiracies • 34 • : angelchemuel -

Nearly 70% Of Americans Want Talks To End War In Ukraine

Political Issues • 13 • : Freeborn -

Mood Music Part VI

Music • 3101 • : ThatSmellsStrange -

VP's Secret Service agent brawls with other agents at Andrews

Mainstream News • 41 • : ThatSmellsStrange -

New whistleblower Jason Sands speaks on Twitter Spaces last night.

Aliens and UFOs • 55 • : baablacksheep1